Oaktree Specialty Lending (OCSL)·Q1 2026 Earnings Summary

Oaktree Specialty Lending Q1 2026: Beats on NII as NAV Continues to Slide

February 4, 2026 · by Fintool AI Agent

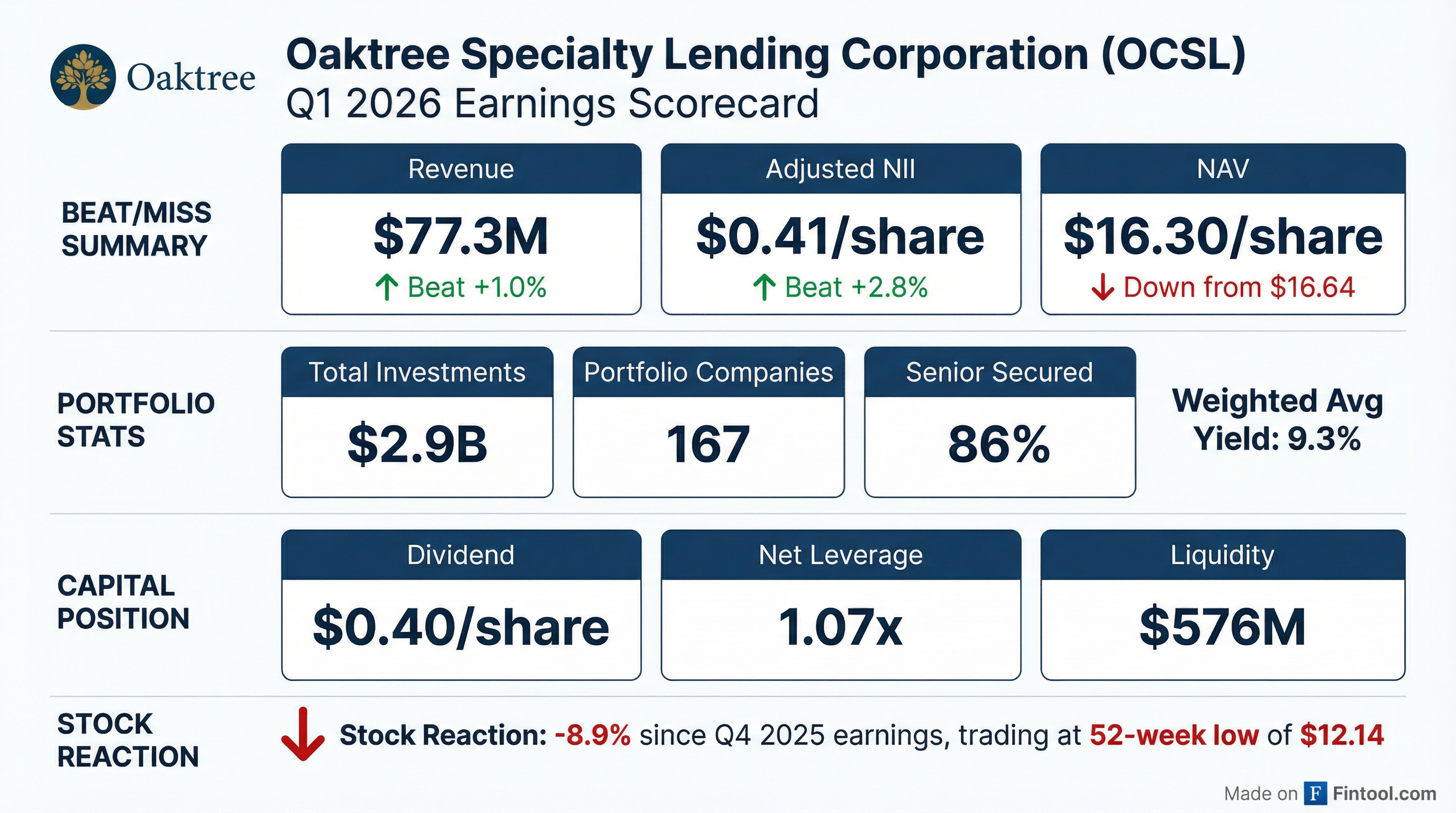

Oaktree Specialty Lending (NASDAQ: OCSL) delivered a modest beat on net investment income in Q1 FY2026, but the BDC's NAV continued its multi-quarter decline. Adjusted NII came in at $0.41/share ($36.1M) versus consensus of $0.39, while NAV dropped $0.34/share to $16.30 . The stock trades at a 25% discount to NAV and hit a fresh 52-week low on the release.

President Matt Pendo opened the call: "This year is off to a good start, and we delivered solid results for the first fiscal quarter of 2026. Adjusted Net Investment Income for the quarter was $36.1 million, or $0.41 per share, up modestly from the prior quarter. Once again, we fully covered our quarterly dividend with earnings."

Did Oaktree Specialty Lending Beat Earnings?

OCSL beat on NII but total investment income declined sequentially:

The NII beat was driven by lower net expenses, particularly a $4M reduction in Part I incentive fees due to the total return hurdle . Adjusted total investment income declined primarily due to lower interest income from falling base rates and lower OID acceleration, partially offset by higher fee income from prepayment and exit fees .

Beat/Miss History (Last 8 Quarters):

Values retrieved from S&P Global

What Happened to NAV?

NAV per share fell to $16.30, down $0.34 from $16.64 in Q4 2025 . CFO Chris McKown noted the largest detractor was Pluralsight, accounting for 38% of the unrealized depreciation . The NAV bridge shows:

- Adjusted NII: +$0.41

- Net Unrealized Depreciation: -$0.37

- Net Realized Gain: +$0.02

- Quarterly Distribution: -$0.40

- Merger Accounting Adjustments: -$0.01

The unrealized losses were the primary drag, reflecting mark-to-market pressure across the portfolio—particularly in stressed tech/software positions that traded down on small-ticket CLO sales . This marks the sixth consecutive quarter of NAV declines, from $19.14 in Q2 2024 to $16.30 today.

NAV Trend (Last 8 Quarters):

NAV has declined 15% over 8 quarters. Book Value per Share retrieved from S&P Global.

How Is the Portfolio Positioned?

OCSL maintains a senior-secured focused strategy with conservative positioning:

Key observations:

- Yield compression continues: Portfolio yield fell to 9.3% from 10.7% a year ago as rates decline

- Active deployment: New funded investments of $314M (+42% QoQ), offset by $179M of repayments, resulting in $135M net new investments

- New deal spreads at ~500 bps: First lien loans represented 92% of new originations

- Median portfolio EBITDA jumped to $190M: Up from $150M, driven by larger-cap new originations

What About Software Exposure?

Software represents ~23% of the portfolio at fair value across 28 issuers . Key stats:

Oaktree emphasizes targeting large, diversified software businesses with entrenched customer bases and high switching costs . Co-CIO Raghav Khanna outlined their AI-adjusted framework: "We prioritize software businesses with multiple control points, data gravity, business context, high mission criticality, and a coherent and credible AI roadmap."

On AI Risk to Software — CEO Armen Panossian provided extensive commentary on the call:

"It's too early to actually see performance degradation in any software name, and it's probably going to take a fair bit of time to actually see any sort of dispersion in performance due to AI... The reason for the concern isn't necessarily near-term weakness in performance. It's more that the concern around the long run calls into question the refinanceability of these loans when they mature."

Armen noted that if LTVs rise to 60%, that's the threshold where refinanceability becomes questionable, and sponsors may not inject additional equity—particularly for funds late in their lifecycle .

What Were the Key New Investments?

The standout deal this quarter was Premier, Inc., a healthcare services company acquired by Patient Square Capital in a take-private at $2.6B enterprise value :

- Oaktree Role: Joint lead arranger, providing ~40% of first lien term loan and 30% of revolving credit facility

- Pricing: SOFR + 650 bps with 2 points OID (all-cash coupon)

- Thesis: Strong competitive positioning, healthcare spending tailwinds, high customer switching costs

Overall new funded investments totaled $314M (+42% sequentially), with first lien loans representing 92% of originations . The average all-in spread and yield on new private investments was 525 bps and 9%, respectively .

What's on Non-Accrual?

Non-accruals represented 3.1% of total debt portfolio at fair value, down ~85 bps year-over-year . There are currently 11 investments on non-accrual .

Pluralsight was the largest NAV detractor this quarter—the equity position was marked to zero and the second-lien term loan was marked down . This single name accounted for ~38% of the total unrealized depreciation .

Avery was a positive development—a portion of the loan was put back on accrual status following restructuring, and unit sales appear to be accelerating .

What Is the Leverage and Liquidity Position?

OCSL operates within its 0.90x to 1.25x target leverage range :

Funding structure remains well-laddered :

- 59% unsecured borrowings

- Weighted average interest rate on debt: 6.1% (down from 6.5% in Q4)

- Investment grade rated by Moody's and Fitch

- No maturities until 2027 Notes ($350M due Jan 2027)

- Credit facility: $495M undrawn capacity

Joint Ventures: The two JVs hold $511M of investments across 135 portfolio companies (primarily BSL) and generated 12% aggregate ROE this quarter with 1.7x leverage .

How Did the Stock React?

OCSL closed at $12.14 on February 4, 2026 and hit a fresh 52-week low of $11.94 intraday. The stock trades at just 74% of NAV ($12.14 vs $16.30 NAV).

The persistent NAV erosion and yield compression as rates decline have pressured the stock. Despite the dividend remaining covered at $0.40/share vs $0.41 adjusted NII, the market is pricing in continued headwinds.

What Are the Key Oaktree Support Actions?

Oaktree has taken several actions to support the stock:

- $100M Equity Investment (Feb 2025): Purchased shares at NAV ($17.63), representing a 10% premium to market price

- Incentive Fee Cap: The total return hurdle resulted in a $4M reduction in Part I incentive fees this quarter

What Should Investors Watch?

Positives:

- Dividend fully covered (102.5% coverage ratio)

- Senior-secured focus (85% first lien) with conservative underwriting

- Active deployment: $314M funded (+42% QoQ) at 9% all-in yields

- Oaktree alignment through fee waivers and total return hurdle

- Non-accruals declining (-85 bps YoY to 3.1%)

- Spreads appear to have bottomed at SOFR + 450-475 bps

Concerns:

- Six consecutive quarters of NAV erosion (down 15% from $19.14 to $16.30)

- Yield compression accelerating as rates fall (9.3% now vs 10.7% year ago)

- Stock at significant discount to NAV (74.5%)

- Unrealized losses persist—tech/software markdowns on thin trading

- AI risk to software portfolio (23% of fair value) remains medium-term concern

What Did Management Say on the Call?

On Private Credit Market Dynamics — CEO Armen Panossian:

"Since the Fed rate cut in September, we have seen greater price discipline in the market and believe that spreads in private credit have now bottomed out at SOFR plus 450-475 basis points... We are cautiously optimistic that spreads will remain stable in 2026, with the potential to widen."

"Direct lending transactions continue to offer an approximate 150 basis point spread premium relative to broadly syndicated loans with similar credit quality."

On M&A and Deal Flow:

"While large cap activity accelerated in the December quarter, middle market volumes were still below historical averages. That said, we are starting to feel more confident that middle-market M&A activity will improve over the course of the year."

On Portfolio Median EBITDA Jump ($150M → $190M) — Co-CIO Raghav Khanna:

"It was really driven by our new originations that we funded in the fourth quarter, which were pretty large companies. They were all large cap, mostly on the sponsor side, mostly in the US."

On Stressed Positions in Public Markets:

"A lot of those technology names are trading down on $2 million and $3 million trades, mostly from CLO sellers who are trying to manage their WARF tests and rating tests. We're not seeing huge selling in those positions... There isn't enough volume to actually want to step in and try to be a buyer."

Read More: OCSL Company Profile | Q1 2026 Earnings Transcript | Q4 2025 Earnings